Federal

1. The federal tax credit covers 30% of an EV charging station, necessary equipment and installation costs. For residential installations, the IRS caps the tax credit at $1,000.

Federal Tax Credit for Residential EV (rebates4evchargers.com)

2. The US Environmental Protection Agency (EPA) is offering $3 Billion for port authorities and state, regional, local, and tribal agencies with jurisdiction over ports, and air pollution control agencies to deploy zero-emission port equipment and to purchase and install charging infrastructure through its Clean Ports Program. EPA will provide reimbursement of up to $500 Million, up to 80-90% of total eligible project costs, depending on applicant and project details. Applications will be evaluated competitively and will be accepted between February 2024 and May 2024.

3. The National Electric Vehicle Infrastructure Formula Program allocates $5 billion in funding for EV charging infrastructure across 75,000 miles of highway across the country. Your organization must be within one mile of an established alternative fuel corridor to qualify and may need to meet other requirements as well.

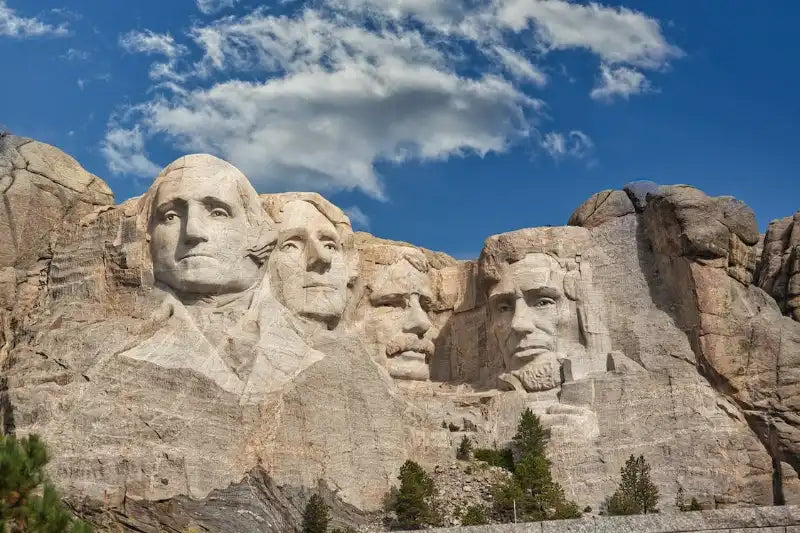

South Dakota

1. Black Hills Energy offers rebates to commercial customers for the purchase and installation of Level 2 and direct current (DC) fast chargers. Rebates are available on a first-come, first-served basis. For more information, including application details, see the Black Hills Energy Commercial EV Charging Rebate website.

2. Black Hills Energy offers residential customers a rebate of up to $500 for the purchase and installation of a Level 2 EV charger. Rebates are available on a first come, first served basis.

Electric vehicle charging rebate for your home | Black Hills Energy